*The General Manager of Corporate Management oversees management as a whole (Corporate Planning, Finance & Accounting, PR & IR, Personnel, Recruitment & Training, General Affairs, and Legal) and plays an important role in carrying out the management strategy.

Business environment and commencement of the Medium-term Business Plan

The automotive industry has reached the significant milestone of the transition to a next-generation mobility society. The business environment surrounding us is changing rapidly each day, causing a highly uncertain situation with an unpredictable direction and speed.

The automotive aftermarket is also seeing an acceleration in M&As through companies from different industries and expansion into related businesses, causing competition for customer acquisition to become more intense than ever before. With technological innovation and societal maturation, consumer values and purchasing behavior are also becoming more diverse.

Amidst this environment, we determined that it would be difficult to achieve sustainable growth with only the conventional business model centered on sales of automotive goods and services, and we took steps toward transformation aimed at creating new value. Specifically, we are promoting strategic business operation by restructuring the AUTOBACS Business with changes to the franchise chain package, expanding into related businesses through M&A, and creating synergy between businesses.

This transformation serves as an important stepping stone not only for expanding businesses, but also for improving capital efficiency and profitability. As the General Manager of Corporate Management, I strive to take appropriate measures while holding ongoing discussions with the management team, always considering how to effectively allocate limited management resources to maximize corporate value. In particular, I consider it my important obligation to properly balance risks and returns while maintaining alignment between the financial strategy and business strategy.

Results of the first year of the Medium-term Business Plan

As the first year of the Medium-term Business Plan "Accelerating Towards Excellence" (hereinafter, the "current Medium-term Business Plan"), FY2024 was an extremely important year for taking the first step towards the next growth stage. The results of the first year were a litmus test for the future effectiveness of the growth strategy, and the significant improvement in business performance brought about a solid sense of progress.

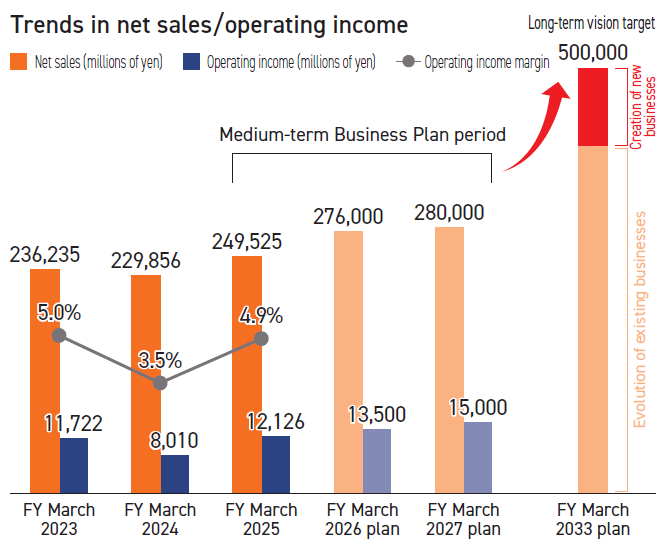

As shown below, increased sales and profits were seen in the consolidated business performance.

- Consolidated net sales: 249.5 billion yen (+8.6% YoY)

- Consolidated operating income: 12.1 billion yen (+51.4% YoY)

- Profit attributable to owners of parent: 8.1 billion yen (+28.0% YoY)

These results are due not simply to increasing the numbers, but to steadily implementing the key measures established by the Company. In particular, the key measure of "creating touch points" has contributed significantly to increasing profits on a consolidated basis. In addition to opening 13 new AUTOBACS stores, we expanded to a total of 101 stores through the M&A of authorized Honda dealers, used car dealerships that provide in-house loans, and tire specialty stores. Furthermore, the contribution of newly consolidated subsidiaries to performance has also become apparent.

The current Medium-term Business Plan sets the following targets for FY2026.

- Consolidated net sales: 280.0 billion yen

- Consolidated operating income: 15.0 billion yen

- ROIC: 7.0%

These targets were calculated by backcasting, aiming for consolidated net sales of 500.0 billion yen in FY2032, the final year of the long-term vision. They are positioned as the minimum level that must be reached to ensure sustainable growth for the Company.

These numerical targets are viewed as milestones to balance capital efficiency with profitability. In particular, I believe that improving ROIC will lead directly to continuous enhancement of corporate value, and that this indicator will play a central role in future investment decisions and business evaluations.

Trends in reporting segments

AUTOBACS Business: In addition to increased demand for maintenance due to longer vehicle lifespans, service sales increased with the introduction of the "AQ. pit menu," a selection of original low-cost, high-quality pit services. Tire sales also increased in monetary amount and quantity as a result of last year's mild winter.

Consumer Business: Although M&A-related costs were incurred by making four companies into subsidiaries, sales increased by 7.4 billion yen and operating income improved. Existing businesses such as sale of new and used cars and online sales increased, increasing sales and reducing deficit.

Wholesale Business: While sales increased due to increased domestic wholesale sales to customers such as Nissan Motor and 7-Eleven, profits decreased due to a decline in overseas exports.

Expansion Business: Finance remained strong due to increased interest rates and progress in cashless payment. Real estate income also improved with increased sales and profits.

Promotion of the financial strategy aimed at continuous enhancement of corporate value

We are promoting the restructuring of our business portfolio under the current Medium-term Business Plan’s policy to concentrate management resources on the two axes of retail and wholesale, which are our strengths. In FY2024, we strengthened our competitiveness in the retail area through M&As of tire retailers, used car dealerships, and companies that operate maintenance bases. Furthermore, in July 2025, we spun off part of our used car purchasing and sales business and our real estate management and brokerage business with a view to enhancing our business portfolio management system.

This is not simply an organizational restructuring, but a strategic effort aimed at improving capital efficiency and maximizing corporate value. In particular, after repeated careful consideration from the perspective of financial rationality and strategic alignment, we established a hurdle rate for M&As based on weighted average cost of capital (WACC: 5-6%) and factoring in a risk premium based on the features of the applicable businesses, based on which the Board of Directors makes appropriate decisions. During the post-acquisition integration process, we focus on creating synergy and improving capital efficiency, and we have developed a quantitative evaluation system.

The new franchise chain package launched in April 2024 revised the revenue structure by reducing wholesale prices to franchisees and increasing the retail royalty rate. Furthermore, we are promoting the standardization of high-quality services on a total store basis by incorporating DX tools and training costs for stores into royalties. These measures promote the steady development of infrastructure aimed at sustainable growth by improving customer satisfaction and promoting the restructuring of stores, which are our source of revenue.

On the other hand, in FY2023, we promoted business development by closing overseas stores and dissolving overseas joint ventures. This was a strategic withdrawal decision emphasizing capital efficiency. Going forward, we will continue to optimize our business portfolio by making decisions related to restructuring and withdrawal while accurately assessing business growth phases and changes in the market environment.

Capital cost and stock price-conscious management

In order to achieve sustainable growth and enhance corporate value, we consider management conscious of capital efficiency and capital cost to be an important issue. I believe that suggestions obtained through dialogue with capital markets are essential for establishing the direction of the financial strategy, and that they will lead directly to fundamentally enhancing corporate value.

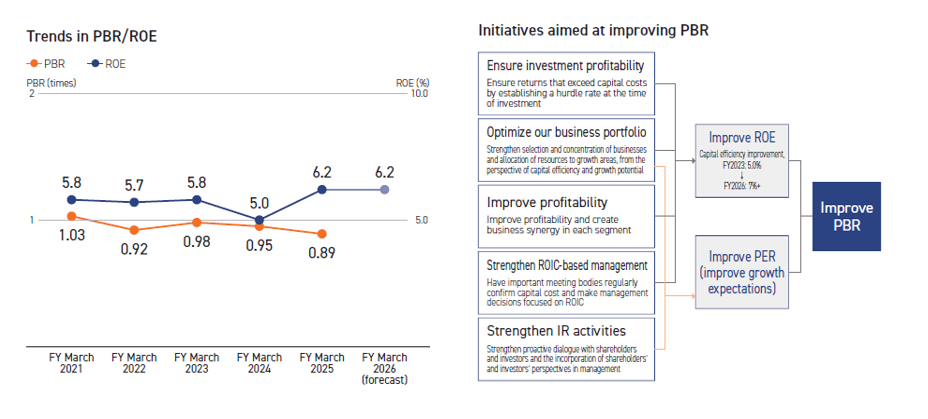

However, PBR is currently below 1.0, which we are aware falls short of capital market expectations. We recognize contributing factors to be the limited nature of market assessments on the growth potential of the AUTOBACS Business, which is our core business, and the as yet insufficient visualization of the results of reforms such as the changes to the franchise chain package in April 2024.

In response to this issue, we established a policy of concentrating management resources on the two axes of retail and wholesale under the current Medium-term Business Plan, and in July 2024, we changed the reporting segments and conducted organizational restructuring. This aims to optimize our business portfolio and strengthen our strategy implementation capabilities, and it is also an important measure from a financial standpoint, aimed at striking a balance between capital efficiency and growth potential.

In addition, we have been strengthening ROIC-based management since FY2023, and we established an ROIC target for each business in FY2024. We have established a system in which ROIC by segment and capital cost are regularly confirmed by important meeting bodies and reflected in management decisions. These values are positioned as measures of management quality, and we are focused on spreading internal awareness of them.

In future growth investments, we will thoroughly assess quantitative return on investment using the ROIC indicator and continue to make decisions focused on return on invested capital. The current Medium-term Business Plan establishes a target ROIC of 7.0% for FY2026. In FY2024, ROIC was 5.6% due to the acquisition of fixed assets from M&As, but we aim to achieve the target through business growth and increased profitability.

For ROE, we will first set a target of 7.0%, which we consider the minimum level that must be exceeded. We will aim for further improvement in the next Medium-term Business Plan.

Balancing growth investments and shareholder returns

The current Medium-term Business Plan calls for total growth investments of 35.0 billion yen in the three-year period from FY2024 to FY2026, with 17.0 billion yen of which allocated to M&As. In FY2024, we invested approximately 10.0 billion yen in M&As and made multiple retail businesses into subsidiaries in the Consumer Business. Furthermore, we promoted active investment from the first year of the plan, making roughly 9.0 billion yen in capital investments with a focus on opening new stores. In this way, we are already more than 50% of the way to achieving our three-year investment plan.

Going forward, we will strengthen investments in business infrastructure development such as IT and logistics, aiming to achieve growth and create business synergy for the subsidiaries that have become part of the Group. On the other hand, we will continuously monitor businesses and sites that are not expected to be profitable, eyeing the possibility of withdrawal or downsizing.

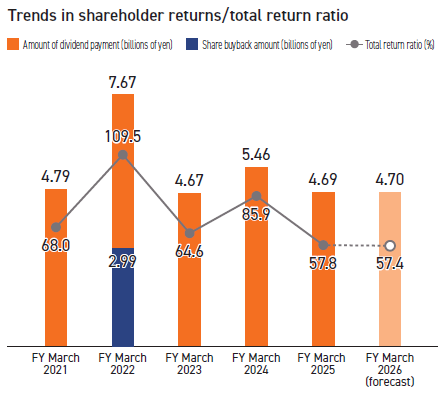

With regard to shareholder returns, we have established a basic policy of prioritizing investments in growth opportunities aimed at achieving our long-term vision and providing stable annual dividends of 60 yen per share. We will continue to promote a sustainable dividend policy while taking into account the balance with growth investments.

Initiatives aimed at enhancing corporate value

Aiming to continuously improve corporate value, the AUTOBACS SEVEN Group promotes integrated capital management, including the non-financial areas of human capital, intellectual capital, and natural capital, as well as the financial areas. By incorporating the ESG perspective into management, we strive to achieve long-term growth and gain the trust of stakeholders while fulfilling our social obligations.

Among these, we recognize human capital as an important foundation for corporate competitiveness and sustainability. We are working to establish an environment in which all employees can grow independently by developing employee skills, improving engagement, and promoting diverse work styles. These initiatives will also lead us to improve productivity and create innovation, and I believe they will directly result in enhancing corporate value.

In addition, dialogue with investors is recognized as an important management activity for enhancing corporate value. Feedback, requests, expectations, and concerns received through IR interviews and financial results briefing are regularly reported to the management team and the Board of Directors and reflected in our business plan formulation and information disclosure policies.

In FY2025, we are also working on specific improvements such as expanding the scope of disclosure for each segment. As honest and clear information sharing is essential to building trust with capital markets, we will carefully communicate the Group’s medium- to long-term growth strategy through integrated reports and a variety of other communication tools.

Our long-term vision to achieve 500.0 billion yen in consolidated net sales in FY2032 is a bold and ambitious goal that lies beyond our usual trajectory. The current Medium-term Business Plan, which is positioned as the first step towards this goal, is an extremely important milestone that will influence the Company’s regrowth. As the General Manager of Corporate Management, with steady achievement of the current Medium-term Business Plan as a given, I will continue putting my utmost effort into enhancing corporate value in terms of both financial strategy and non-financial value as a financial leader who supports the achievement of sustainable business growth and enhanced corporate value.