The Company believes that responding to climate change is an important management issue and expressed its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in June 2022. Based on the TCFD recommendations that require disclosure of information regarding financial impact of risks and opportunities brought about by climate change, the Company will proactively disclose information on governance, risk management, strategy, and metrics and targets. Through the increased disclosure of information related to climate change, the Company will facilitate a dialogue with stakeholders and aim to further enhance its corporate value.

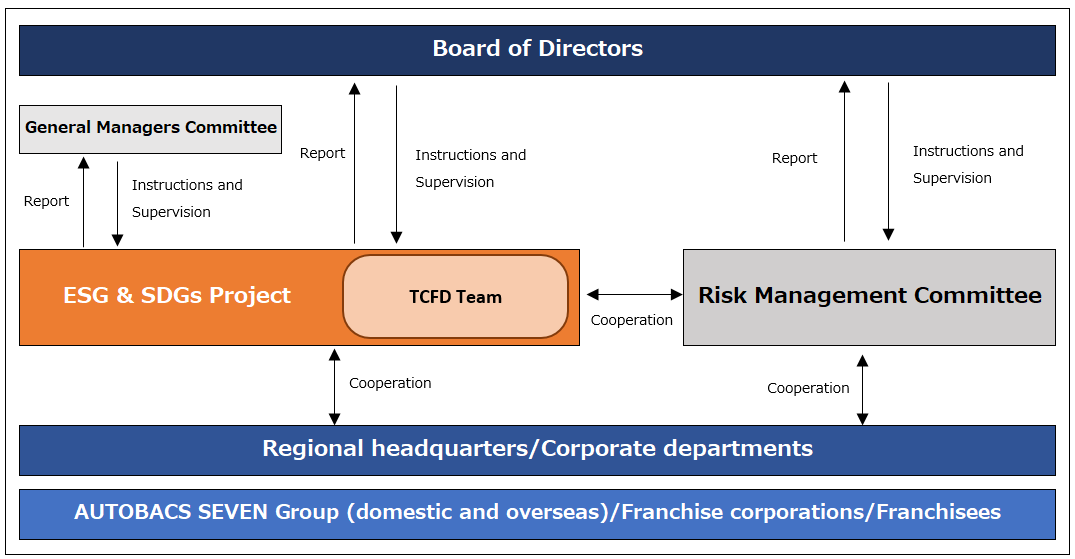

In January 2021, the Company established the ESG & SDGs Project, led by Chief Executive Officer, aiming at management which integrates initiatives for environmental consideration, resolution of social issues, and governance with business as a whole. The contents of relevant discussions and decisions are reported to the Board of Directors, and the Board provides approval on the Company’s initiatives, issues instructions and conducts supervision, as necessary. The Board of Directors also makes reports to the General Managers Committee and provides necessary instructions and supervision.

In April 2023, the Group established a Sustainability Basic Policy and other related policies and is endeavoring to ensure compliance and to maintain and enhance a sound and solid corporate governance system. The Group is also committed to integrating ESG considerations into its other policies with the aim of implementing business activities for the realization of a sustainable society.

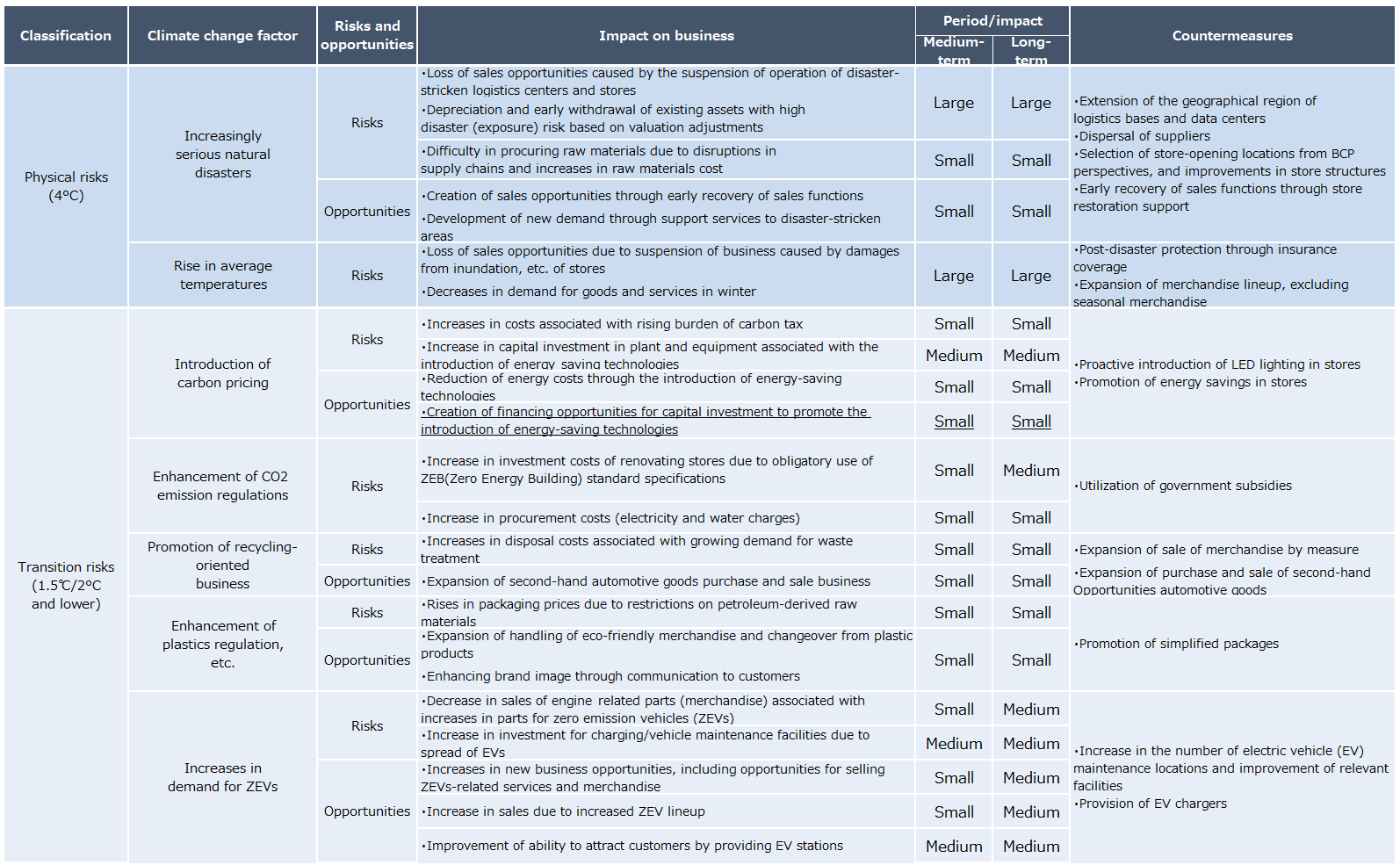

The Company views risks and opportunities associated with climate change as one of the important perspectives to be considered when formulating its business strategy. With 2050 as the timeframe, the Group assumed two scenarios: the 1.5℃/2℃ scenario, assumes that governments “work to limit the global average temperature increase to well below 2°C in comparison with pre-industrial revolution levels, preferably to 1.5°C,” in line with the overarching goal of the Paris Agreement, and the 4℃ scenario, which assumes that greenhouse gas emissions continue to increase at the current pace. Based on these two scenarios, the Group identified climate-related risks and opportunities and then identified the transition risks and physical risks created by climate change and the opportunities arising from adaptation to climate change, in line with the TCFD recommendations.

Under the 4°C scenario, the Company’s business may be significantly affected by increases in drought, heavy rain and other extreme weather events, and there may be a suspension of operation of disaster-stricken logistics centers and stores due to the impact of the rapid emergence of physical risks, and decreases in the demand for goods and services in winter. Regarding logistics and data centers, the Company has already been minimizing physical risks by means such as the extension of geographical regions and development of backup systems. The Company also considers that physical risks regarding stores may be minimized through measures against water immersion risks, such as the selection of store location and development of store structures, from business continuity plan (BCP) perspectives. For its merchandise, the Company is striving to minimize opportunity loss associated with decreases in demand for merchandise and services in winter by introducing merchandise and services that match changes in temperature zones and consumer behavior.

UUnder the 1.5°C /2°C (or lower) scenario, as there will likely be changes in society with advances in technological innovation and stricter regulations toward the containment of global warming, the Company considers that there will be a more direct impact from transition risks. Moreover, while, with developments such as the introduction of carbon tax and emissions trading, incentives for ZEV manufacturers, and stricter regulations on internal-combustion vehicles, it is assumed that the number of vehicles powered by engines shipped will rapidly decrease, to be replaced by zero-emission vehicles (ZEV), the Company expects increased sales as a result of sales expansion of ZEV and will also endeavor to expand sales opportunities by proactively working to develop an infrastructure for the promotion of ZEVs.

As impacts of climate change may manifest themselves over the medium- to long-term, the Company periodically examines the analysis and evaluation of risks and opportunities and develop specific measures in light of changes in external trends, among other things, and incorporates the results into medium- to long-term management strategies.

- Subject of analysis

[Business] Domestic AUTOBACS Business, and Car Dealership, BtoB and Online Alliance Business

[Scope] In Japan (Business locations, directly managed stores and stores of subsidiaries, logistics bases)

[Period] Present until 2050 (short term: no more than one year; medium-term: until 2030; long-term: until 2050)

- Steps in analysis

(1) Systematically identify potential impacts of each climate-related risk and opportunity factor to the scope of analysis targets.

(2) Take a bird’s eye view of results of (1) and identify risks with higher probability of occurrence

(3) Based on a scenario applied (physical risk: Representative Concentration Pathways (RCP) 2.6 and RCP8.5, Transition risk: net zero energy (NZE) and the Stated Policy Scenario (STEPS)), inspect impacts on business and calculate financial impacts under the 2°C (or lower) and 4°C scenarios.

(4) Examine measures to respond to results of (3).

- Reference documents

Climate change monitoring report 2020 (Japan Meteorological Agency (JMA)); Climate change in Japan 2020 (Ministry of Education, Culture, Sports, Science and Technology and JMA); MLT Hazard Map Portal Site (Ministry of Land, Infrastructure, Transport and Tourism); Global Hybrid & Electric Vehicle Forecast (LMC Automotive); IPCC (Intergovernmental Panel on Climate Change)’s Sixth Assessment Report (AR6) and Working Group 1 (WG1) Report; International Energy Agency World Energy Outlook 2021; Outlook for electrification of vehicles (Bureau of Taxation, Tokyo Metropolitan Government), etc.

Physical risks: Risks caused by climate change, such as intensification of climate-related disasters

Transition risks: Risks caused by transition to low-carbon economy associated with regulations concerning greenhouse gas emissions, etc.

As an organization to centrally manage company-wide risks, the Company has established the Risk Management Committee, chaired by Representative Director & Chief Executive Officer, for identifying important risks through periodic reviews of latent risks in business activities and the enhancement of risk control systems.

The Committee analyzes and evaluates the risk exposure of the Company’s business, frequency of risk occurrence, etc., discusses countermeasures against risks, from the greatest risks to the smallest, and implements control in advance. Moreover, it reports on important risks to the Board of Directors and provides support to each department in addressing risks in a concrete manner.

Regarding sustainability-related risks, ESG & SDGs Project plays the central role in collecting risk information from each business segment and identifies and evaluates risks. By sharing the identified risks and progress in response with the Risk Management Committee, risks are integrated into a risk control list of the entire organization.

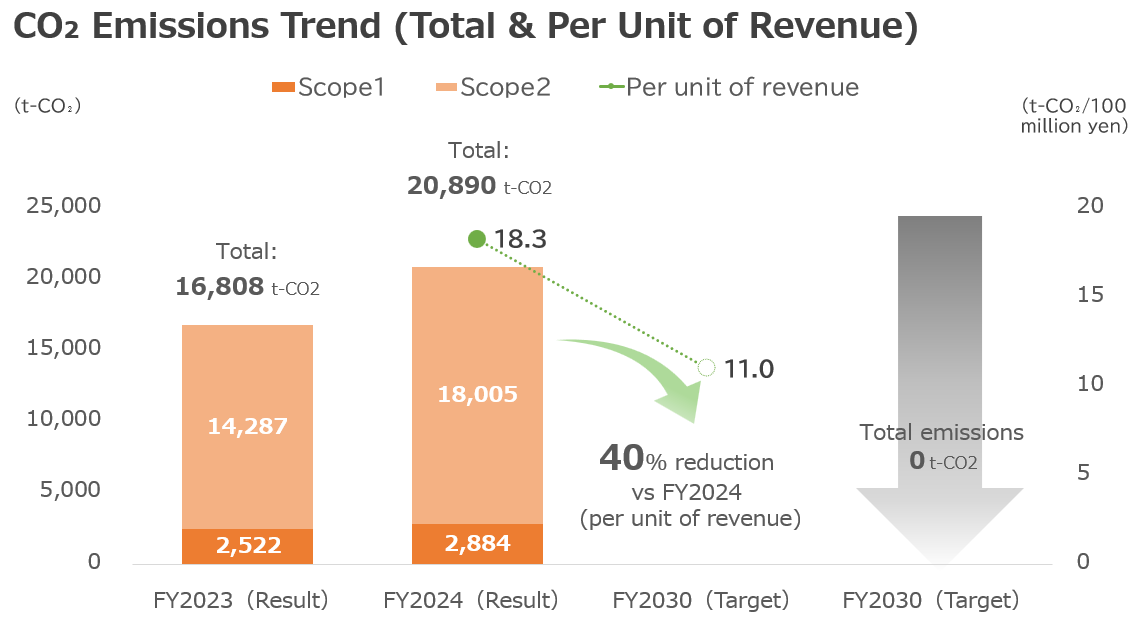

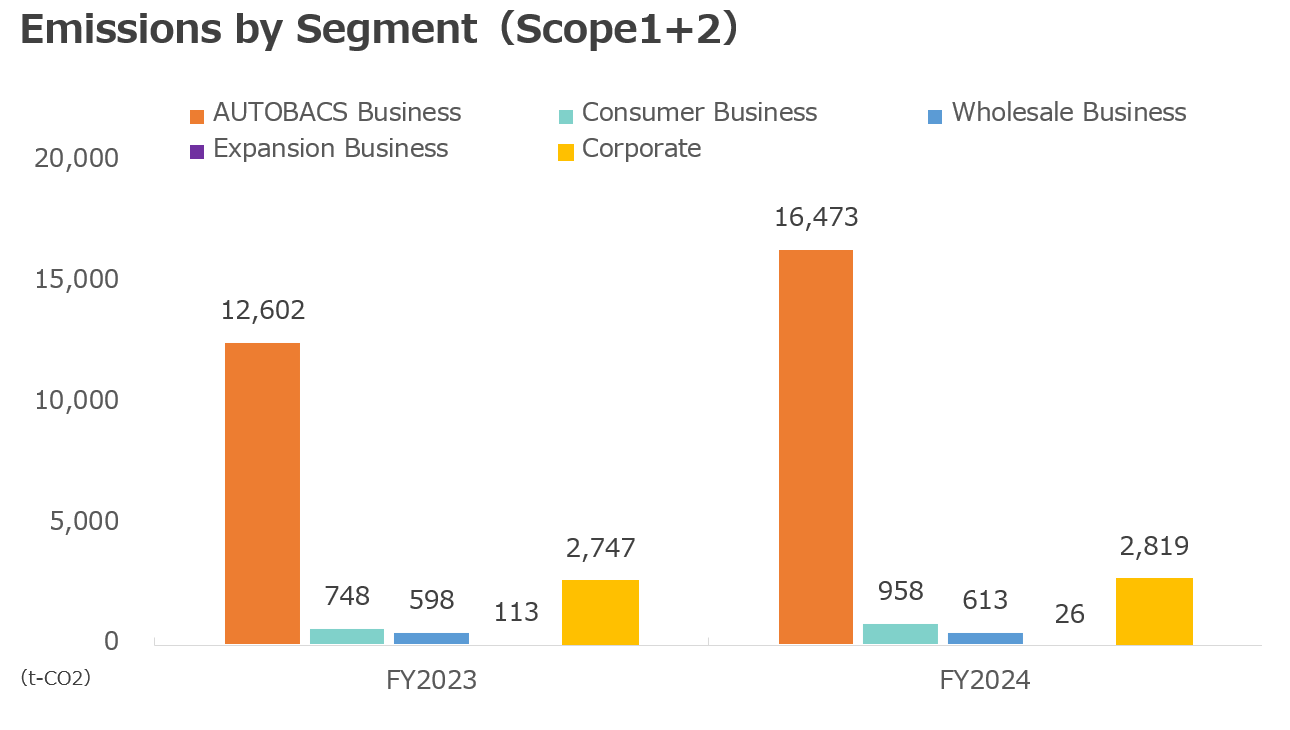

We are working to reduce greenhouse gas emissions with the goal of creating a safe, secure, and inclusive society where people, cars, and the environment coexist in harmony. Our reduction target is to cut CO₂ emissions per ¥100 million in sales revenue by 40% compared to FY2024, to 11.0 (t-CO2/100 million yen) by FY2030. In FY2024, CO2 emissions per 100 million yen in sales were 18.3 (t-CO2/100 million yen). Furthermore, in line with the Japanese governmentʼs declaration, we are advancing initiatives to achieve carbon neutrality (net-zero emissions) by FY2050.

- FY2023

Scope: Domestic business sites, directly operated and subsidiary stores, logistics hubs (204 locations)

Calculation Period: April 1, 2023 to March 31, 2024

- FY2024

Scope: Domestic business sites, directly operated and subsidiary stores, logistics hubs (223 locations)

Calculation Period: April 1, 2024 to March 31, 2025

Scope 1: All direct greenhouse gas emissions from fuel combustion, industrial processes and other emissions generated by businesses themselves.

Scope 2: Indirect emissions resulting from the use of electric power, heat and steam supplied by other companies