Through our group companies, our company provides a wide range of products and services to numerous customers, and we recognize that continuously working to maintain and enhance each of our brands, including the “AUTOBACS” brand, which enjoys strong support and trust from all stakeholders, is the most important management priority.

To this end, we not only respond to the daily changes in the environment surrounding the Group, but also accurately identify, evaluate, and appropriately control various risks that may hinder the achievement of our goals. In addition, we strive to fulfill our corporate social responsibility by establishing a system that enables us to minimize damage and loss in the event of a serious incident and prevent the spread of such damage.

We will continuously work on improving integrated risk management throughout our Group and aim to become a corporate group that has gained the trust of its stakeholders.

The scope of integrated risk management shall include our company and its consolidated subsidiaries (hereinafter referred to as the AUTOBACS SEVEN Group), and all risks that may hinder the maintenance and enhancement of our group’s brands, as well as any crises that occur, shall be subject to Integrated Risk Management.

- Stable business continuity

- Securing the safety of customers, local residents, officers, employees and their families

- Perform our social responsibility

- We shall make constant efforts to develop awareness of significant risks associated with business activities of the AUTOBACS SEVEN Group and we shall never overlook risks.

- We shall pay sufficient attention to trends and demands of society regarding risks and work for the continuous improvement of integrated risk management and the enhancement of our ability to deal with risks.

- Each and every officer and employee of the AUTOBACS SEVEN Group shall act with risk management awareness.

- In our integrated risk management activities, we shall always keep in mind the safety of customers, members of local communities, officers and employees of the AUTOBACS SEVEN Group and their families and the conservation of operating resources.

- In the event that risks materialize, we shall act responsibly and devote efforts to respond to and recover from said risks in a prompt and appropriate manner.

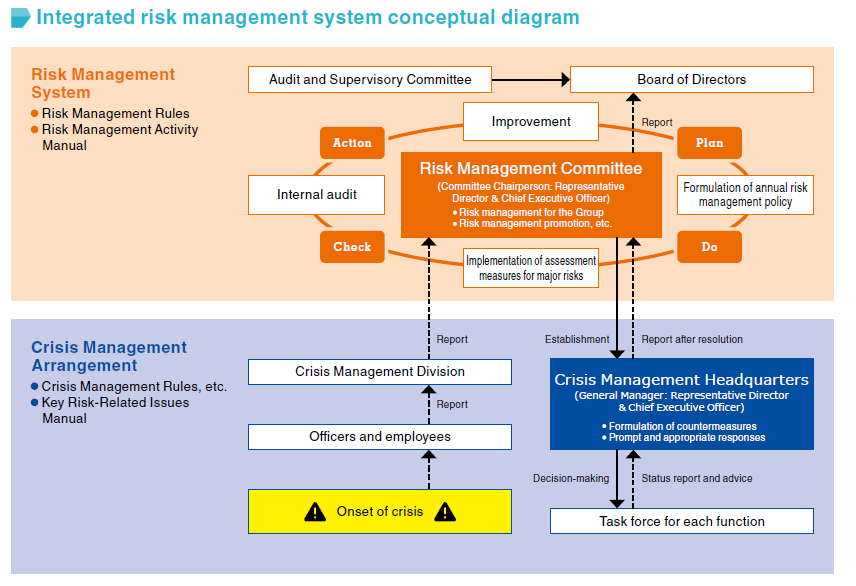

We established a “Risk Management Committee,” chaired by the Representative Director & Chief Executive Officer, and composed of Executive Directors and members appointed by the Chairperson. This committee is responsible for managing risks within the AUTOBACS SEVEN Group and for building and promoting a company-wide risk management system.

In the event of an emergency, the Representative Director & Chief Executive Officer, who serves as the Chairperson of the Risk Management Committee, will establish a “Crisis Response Headquarters,” take command personally, and strive to ensure a prompt and appropriate response and recovery.

* The Integrated Risk Management Structure includes a risk management system and a crisis management system

* The term crisis refers to an event that has or could have a significant impact on the management or business continuity of the AUTOBACS SEVEN Group.

The Risk Management Committee will continuously conduct awareness and educational activities on Integrated Risk Management for directors and employees, ensuring that the Integrated Risk Management framework functions effectively in both normal times and during emergencies.